Stock traders and stock investors

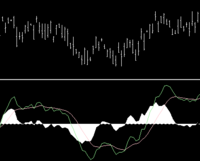

Stock traders and stock investorsCharting is the use of graphical and analytical patterns and data to attempt to predict future prices.

Individuals or fi

rms trading equity (stock) on the stock markets as their principal capacity are called stock traders. Stock traders usually try to profit from short-term price volatility with trades lasting anywhere from several seconds to several weeks. The stock trader is usually a professional. Persons can call themselves full or part-time stock traders/investors while maintaining other professions. When a stock trader/investor has clients, and acts as a money manager or adviser with the intention of adding value to their clients finances, he is also called a financial advisor or manager. In this case, the financial manager could be an independent professional or a large bank corporation employee. This may include managers dealing with investment funds, hedge funds, mutual funds, and pension funds, or other professionals in equity investment, fund management, and wealth management. Several different types of stock trading exist including day trading, swing trading, market making, scalping (trading), momentum trading, trading the news, and arbitrage.

rms trading equity (stock) on the stock markets as their principal capacity are called stock traders. Stock traders usually try to profit from short-term price volatility with trades lasting anywhere from several seconds to several weeks. The stock trader is usually a professional. Persons can call themselves full or part-time stock traders/investors while maintaining other professions. When a stock trader/investor has clients, and acts as a money manager or adviser with the intention of adding value to their clients finances, he is also called a financial advisor or manager. In this case, the financial manager could be an independent professional or a large bank corporation employee. This may include managers dealing with investment funds, hedge funds, mutual funds, and pension funds, or other professionals in equity investment, fund management, and wealth management. Several different types of stock trading exist including day trading, swing trading, market making, scalping (trading), momentum trading, trading the news, and arbitrage.On the other hand, stock investors are firms or individuals who purchase stocks with the intention of holding them for an extended period of time, usually several months to years. They rely primarily on fundamental analysis for their investment decisions and fully recognize stock shares as part-ownership in the company. Many investors believe in the buy and hold strategy, which as the name suggests, implies that investors will hold stocks for the very long term, generally measured in years. This strategy was made popular in the equity bull market of the 1980s and 90s where buy-and-hold investors rode out short-term market declines and continued to hold as the market returned to its previous highs and beyond. However, during the 2001-2003 equity bear market, the buy-and-hold strategy lost some followers as broader market indexes like the NASDAQ saw their values decline by over 60%.

Methodology

Historical photo of stock traders in the trading floor of the New York Stock Exchange.

Stock traders/investors usually need a stock broker such as a bank or a brokerage firm to access the stock market. Since the advent of Internet banking, an Internet connection is commonly used to manage positions. Using the Internet, specialized software, and a personal computer, stock traders/investors make use of technical analysis and fundamental analysis to help them in making decisions. They may use several information resources, some of which are strictly technical. Using the pivot points calculated from a previous day's trading, they are able to predict the buy and sell points of the current day's trading session. These points give a cue to traders as to where prices will head for the day, prompting each trader where to enter his trade, and where to exit. There is criticism on the validity of using these technical indicators in analysis, and many professional stock traders do not use them. Many full-time stock traders and stock investors have a formal education and training in fields such as economics, finance, mathematics and computer science, which are particularly relevant to this occupation.

Stock traders/investors usually need a stock broker such as a bank or a brokerage firm to access the stock market. Since the advent of Internet banking, an Internet connection is commonly used to manage positions. Using the Internet, specialized software, and a personal computer, stock traders/investors make use of technical analysis and fundamental analysis to help them in making decisions. They may use several information resources, some of which are strictly technical. Using the pivot points calculated from a previous day's trading, they are able to predict the buy and sell points of the current day's trading session. These points give a cue to traders as to where prices will head for the day, prompting each trader where to enter his trade, and where to exit. There is criticism on the validity of using these technical indicators in analysis, and many professional stock traders do not use them. Many full-time stock traders and stock investors have a formal education and training in fields such as economics, finance, mathematics and computer science, which are particularly relevant to this occupation.

Expenses, costs and risk

Trading activitie s are not free. They have a considerably high level of risk, uncertainty and complexity, especially for unwise and inexperienced stock traders/investors seeking an easy way to make money quickly. In addition, stock traders/investors face several costs such as commissions, taxes and fees to be paid for the brokerage and other services, like the buying/selling orders placed at the stock exchange. Depending on the nature of each national or state legislation involved, a large array of fiscal obligations must be respected, and taxes are charged by jurisdictions over those transactions, dividends and capital gains that fall within their scope. However, these fiscal obligations will vary from jurisdiction to jurisdiction. Among other reasons, there could be some instances where taxation is already incorporated into the stock price through the differing legislation that companies have to comply with in their respective jurisdictions; or that tax free stock market operations are useful to boost economic growth. Beyond these costs are the opportunity costs of money and time, currency risk, financial risk, and internet, data and news agency services and electricity consumption expenses - all of which must be accounted for.

s are not free. They have a considerably high level of risk, uncertainty and complexity, especially for unwise and inexperienced stock traders/investors seeking an easy way to make money quickly. In addition, stock traders/investors face several costs such as commissions, taxes and fees to be paid for the brokerage and other services, like the buying/selling orders placed at the stock exchange. Depending on the nature of each national or state legislation involved, a large array of fiscal obligations must be respected, and taxes are charged by jurisdictions over those transactions, dividends and capital gains that fall within their scope. However, these fiscal obligations will vary from jurisdiction to jurisdiction. Among other reasons, there could be some instances where taxation is already incorporated into the stock price through the differing legislation that companies have to comply with in their respective jurisdictions; or that tax free stock market operations are useful to boost economic growth. Beyond these costs are the opportunity costs of money and time, currency risk, financial risk, and internet, data and news agency services and electricity consumption expenses - all of which must be accounted for.

Trading activitie

s are not free. They have a considerably high level of risk, uncertainty and complexity, especially for unwise and inexperienced stock traders/investors seeking an easy way to make money quickly. In addition, stock traders/investors face several costs such as commissions, taxes and fees to be paid for the brokerage and other services, like the buying/selling orders placed at the stock exchange. Depending on the nature of each national or state legislation involved, a large array of fiscal obligations must be respected, and taxes are charged by jurisdictions over those transactions, dividends and capital gains that fall within their scope. However, these fiscal obligations will vary from jurisdiction to jurisdiction. Among other reasons, there could be some instances where taxation is already incorporated into the stock price through the differing legislation that companies have to comply with in their respective jurisdictions; or that tax free stock market operations are useful to boost economic growth. Beyond these costs are the opportunity costs of money and time, currency risk, financial risk, and internet, data and news agency services and electricity consumption expenses - all of which must be accounted for.

s are not free. They have a considerably high level of risk, uncertainty and complexity, especially for unwise and inexperienced stock traders/investors seeking an easy way to make money quickly. In addition, stock traders/investors face several costs such as commissions, taxes and fees to be paid for the brokerage and other services, like the buying/selling orders placed at the stock exchange. Depending on the nature of each national or state legislation involved, a large array of fiscal obligations must be respected, and taxes are charged by jurisdictions over those transactions, dividends and capital gains that fall within their scope. However, these fiscal obligations will vary from jurisdiction to jurisdiction. Among other reasons, there could be some instances where taxation is already incorporated into the stock price through the differing legislation that companies have to comply with in their respective jurisdictions; or that tax free stock market operations are useful to boost economic growth. Beyond these costs are the opportunity costs of money and time, currency risk, financial risk, and internet, data and news agency services and electricity consumption expenses - all of which must be accounted for.Stock picking

Although many companies offer courses in stock picking, and numerous experts report success through Technical Analysis and Fundamental Analysis, many economists and academics state[citation needed] that because of the efficient-market hypothesis it is unlikely that any amount of analysis can help an investor make any gains above the stock market itself. In a normal distribution of investors, many academics believe that the richest are simply outliers in such a distribution (i.e. in a game of chance, they have flipped heads twenty times in a row).

Accumulation/distribution method

Other investors choose a blend of technical, fundamental and environmental factors to influence where and when they invest. These strategists reject the 'chance' theory of investing, and attribute their higher level of returns to both insight and discipline.[citation needed]

Source : http://en.wikipedia.org

Although many companies offer courses in stock picking, and numerous experts report success through Technical Analysis and Fundamental Analysis, many economists and academics state[citation needed] that because of the efficient-market hypothesis it is unlikely that any amount of analysis can help an investor make any gains above the stock market itself. In a normal distribution of investors, many academics believe that the richest are simply outliers in such a distribution (i.e. in a game of chance, they have flipped heads twenty times in a row).

Accumulation/distribution method

Other investors choose a blend of technical, fundamental and environmental factors to influence where and when they invest. These strategists reject the 'chance' theory of investing, and attribute their higher level of returns to both insight and discipline.[citation needed]

Source : http://en.wikipedia.org